Description

The iMA (Moving Average, MA) indicator in this Expert Advisor allows changing the timeframe (MA: timeframe), horizontal shift (MA: horizontal shift), averaging method (MA: smoothing type) and applied price (MA: type of price) – i.e. all parameters except the averaging period. The averaging period is provided in the code and is equal to 55 (this number is used in the EA name).

How it works

The EA only operates during a new bar formation. As soon as the current time (only hours, without minutes and seconds) enters the interval from Start hour to End hour, the Expert Advisor requests data from the indicator. It does not just request data from bar #0 and #1, but it requests data from Bar number #A and Bar number #B.

Then the values on these two bars are compared: if the difference between them is greater than or equal to Difference between bars #A and #B – a position open signal will be generated. The Reverse signals function is disabled by default (set to false), and the following rules apply to a signal:

A BUY signal: MA(Bar number #A) > MA(Bar number #B) + Difference between bars #A and #B;

A SELL signal: MA(Bar number #A) < MA(Bar number #B) – Difference between bars #A and #B.

If you enable closing of opposite positions (set Close opposite positions to true), Sell positions will be closed at the final BUY signal and vice versa.

Volume calculation

Position volume can be fixed – in this case it is specified by the Lots or calculated based on the Risk parameter (Lots must be equal to zero in this case).

How to optimize

You should optimize the EA individually for each symbol and timeframe. Since the EA only performs operations at the new bar formation time, the genetic optimization can be performed in the “1 minute OHLC” tick generation mode.

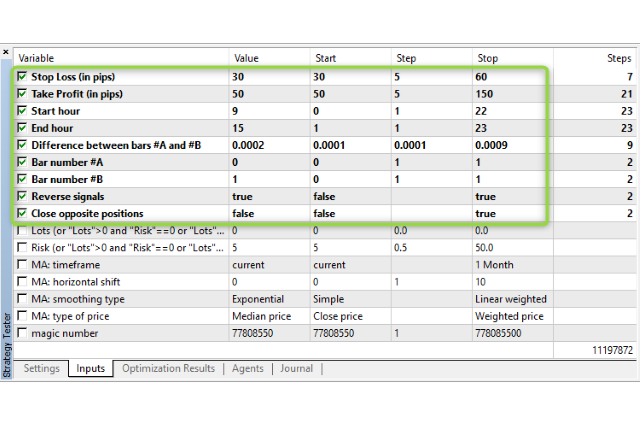

The figure shows approximate parameter limits for timeframes from M15 to H1.